give@fbcfoundation.com

give@fbcfoundation.com

So that we may send you a tax receipt, please include the following information in the Message (Optional) Box provided in the e-transfer process:

- Your full name

- Your home address with Postal Code

Without specific instructions otherwise, your gift will be placed into our Infrastructure Fund. If you would like to direct your gift to a specific fund, please provide your instructions in the Message (Optional) Box.

The Message (Optional) Box can also be used to inform us that the gift is in memory of someone or in commemoration of an event. (please see additional instructions under “Memorial Gifts”, below).

We have engaged Tithe.ly as a selected service provider to do e-Giving, both on-line and via the Tithe.ly app on a smart-phone or tablet platform.

Click here to give

on-line:

It is not necessary to create a Tithe.ly account in order to use Tithe.ly. However, creation of a Tithe.ly account is recommended as it will reduce the time required to make subsequent donations.

Click Here to create a Tithe.ly account

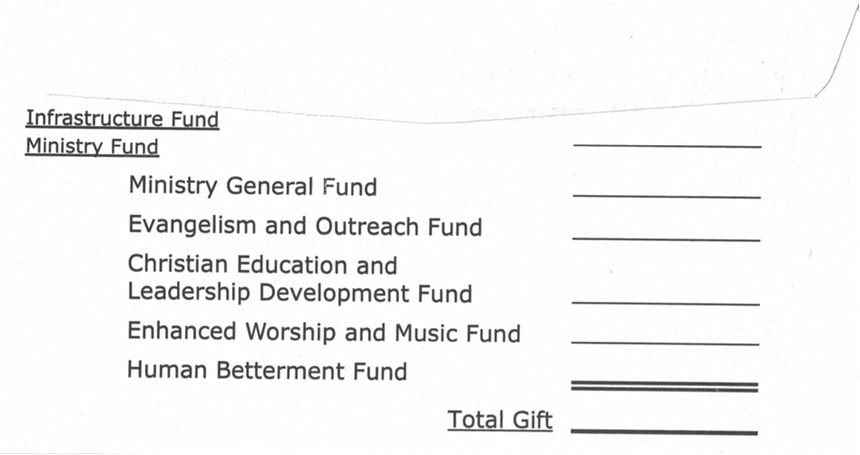

Most gifts given to the FBC Foundation are cash gifts in the form of cheques or physical cash. We ask that you use our FBC Foundation “Gift Envelopes” with your gift. Please fill in the Date, Name, and Address information requested on the envelope so that we can get your tax receipt to you.

Most gifts given to the FBC Foundation are cash gifts in the form of cheques or physical cash. We ask that you use our FBC Foundation “Gift Envelopes” with your gift. Please fill in the Date, Name, and Address information requested on the envelope so that we can get your tax receipt to you.

If you would like to have your gift placed specifically in any of the individual named Foundation Funds, be sure to indicate your preferences by designating the amount(s) in the appropriate line(s) on the back of the envelope. If no preference is indicated, your gift will be placed into the Infrastructure Fund.

If you would like to have your gift placed specifically in any of the individual named Foundation Funds, be sure to indicate your preferences by designating the amount(s) in the appropriate line(s) on the back of the envelope. If no preference is indicated, your gift will be placed into the Infrastructure Fund.

The FBC Foundation accepts non-monetary gifts as well. These “Gifts in Kind” would include various things such as securities (shares of stocks or bonds), life-insurance policies, physical property (houses, boats, cars, or artwork), and the like. These types of donations are dealt with individually, as they receive different CRA tax treatment than do cash donations. Generally (for tax purposes) it is desirable for the donor to donate the “gift-in-kind” as is, in order to minimize/avoid capital-gains taxes. If the item of value is liquidated (sold, to turn into cash), this would generally cause capital-gains taxes to be owed to the CRA. (Please consult your tax advisor for advise on your individual tax situation.)

If you are considering gifting any of these types of assets to the FBC Foundation please contact us directly to discuss how to proceed with the transaction and any special treatment that may be required.